45+ how to calculate mortgage interest deduction

X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. 20000500003333 23000 if.

How Are Mortgage Interest Rates Calculated Quora

Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

. Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Your mortgage lender sends you a Form 1098 in January or early February.

You pay the tax on only the first 160200 of your earnings in 2022. Follow the mentioned steps to calculate mortgage interest deduction limit. Discover Helpful Information And Resources On Taxes From AARP.

Web How to claim the mortgage interest deduction. Ad See how much house you can afford. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Web For each paycheck 62 is deducted for Social Security taxes which your employer matches. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web The deduction applies only to the interest on your mortgage not the principal and to claim it you need to itemize your deductions. Web The state of California does not conform to the new federal law that limits taxpayers to the interest on 750000 375000 for married filing separate of home. Please note that if your.

Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Web Calculate Interest payment as shown below. Look in your mailbox for Form 1098.

Estimate your monthly mortgage payment. Web Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more. Web Also the TCJA lowered the cap on mortgage interest deductions from 1 million to 750000 for married couples filing jointly and from 500000 to 375000 for.

Web You can deduct the part of your interest paid on the amount of debt below the limit. Web Mortgage points are considered. More from NerdWallet 6 Ways Tax Plan Could.

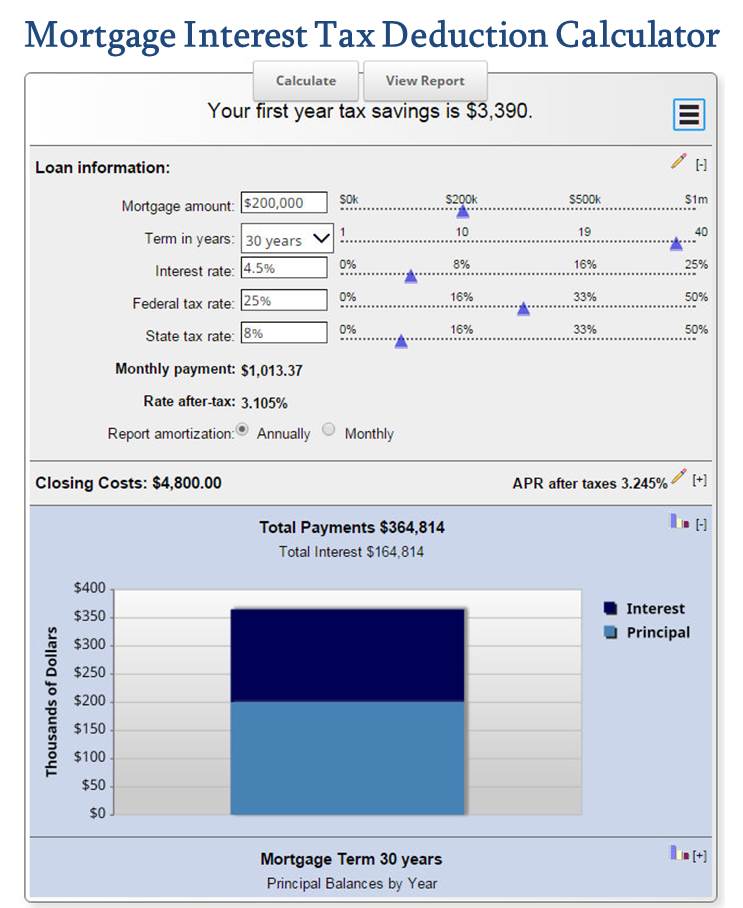

Web if it had been a more expensive loan say 50000 interest you would be able to go above the caped value from the 1st loan. Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. You can use Bankrates.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. However higher limitations 1 million 500000 if.

So the total Interest that is 1000000 5. Web Use NerdWallets mortgage interest deduction calculator to find out what this means for your next mortgage.

Mortgage Tax Deduction Calculator Freeandclear

Explaining The Declined Affordability Of Housing For Low Income Private Renters Across Western Europe Caroline Dewilde 2018

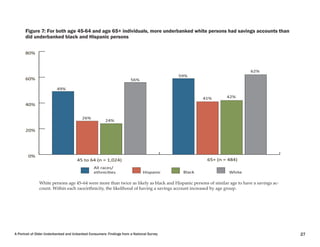

Underbank Economic Full 092110

Swd 2018 0214 Fin Eng Xhtml 13 En Autre Document Travail Service Part1 V9 Docx

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Interest Deduction How It Calculate Tax Savings

4 Ways To Calculate Mortgage Interest Wikihow

Ama Book Of Seminars Winter 2020 By Americanmanagementassociation Issuu

Home Mortgage Loan Interest Payments Points Deduction

Kingdom Of The Netherlands In Imf Staff Country Reports Volume 2008 Issue 171 2008

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Acceleration On An Arm Freeandclear

Reforms Incentives And Flexibilization Five Essays On Retirement

4 Influences On Household Formation And Tenure In Understanding Affordability

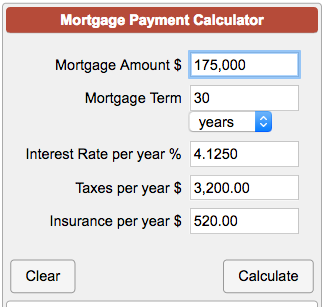

Mortgage Payment Calculator With Taxes And Insurance

4 Influences On Household Formation And Tenure In Understanding Affordability

How To Calculate Mortgage Payments In Excel